The ISM Manufacturing Index cooled to 48.7 from 49.2 in April, showing a contraction in manufacturing for the second straight month. The PMI was 51.90 in March 2024. Productivity is down. Business confidence is slipping. Consumer spending is down and wage increases aren’t keeping pace with inflation. The stock market fell.

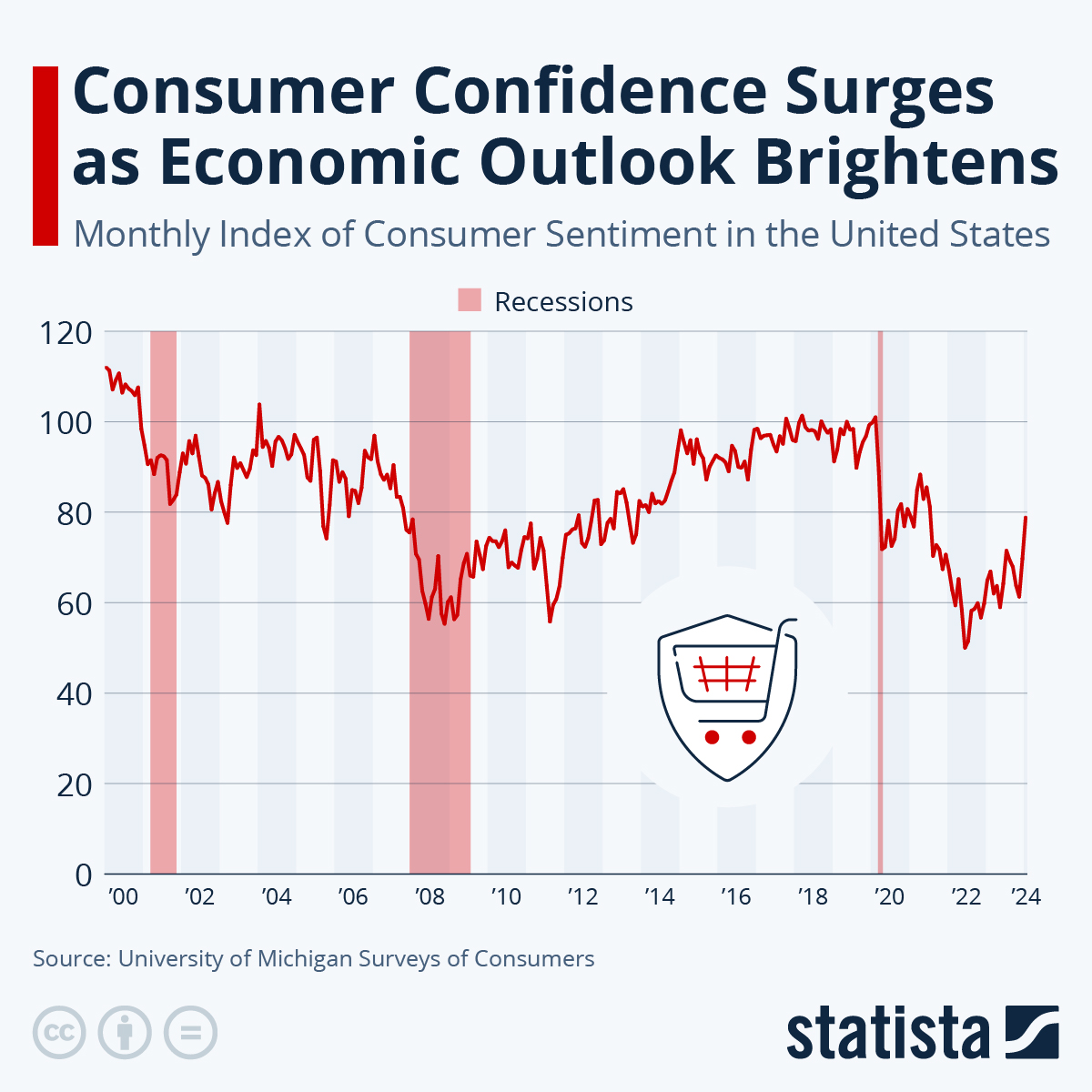

However, jobs are up — unemployment is at a 50-year low. Inflation is down. Consumer confidence is on the upswing. A new report from the Congressional Budget Office found that purchasing power in 2023 was greater than in 2019, at every income level.

Consumer confusion

Consumer confidence is rising this year after the rigors of the pandemic, but consumer confusion seems to be a lot stronger. The majority of Americans think the U.S. economy is in a recession. The facts don’t support that view.

Economists see a couple of reasons for this. One is that measures of inflation don’t include the prices of food and fuel. These two categories of spending are too volatile to produce usable statistics. But they are very important numbers in household budgets.

Food prices have risen, by some estimates, by nearly one quarter since 2020. People who are spending an extra 23.5% on groceries are going to have a hard time feeling like confident consumers.

But consumer spending actually fell over the past month. Some consumers cut back, buying less expensive brands or cheaper items. Even though their spending decreased, they may still feel deprived or nervous as shoppers.

Costs for housing and childcare have also increased since the pandemic.These are major expenses. And some kinds of spending — including entertainment and restaurant meals — fell precipitously doing get pandemic. As long as people continue to think of expenditures in terms of Before the Pandemic and After the Pandemic, they may be comparing apples to oranges.

How this affects manufacturing

Supply and demand inexorably affect manufacturing. If consumers won’t buy, we can’t make the things we want to make. So the belief that we’re in a recession, even if the GDP doesn’t support that belief, can become a self-fulfilling prophecy.

If you use Indramat motion control systems, and plenty of manufacturers do, this may not be the right time to replace them with something new. This may be the time for cost-saving repair and reman. We can help. Contact us for immediate assistance.